About You

Behind every investment decision is a story, about a business built, a retirement planned, or a legacy shaped. Whether you’re a successful professional, a business owner, or planning the next chapter, we take the time to understand your world. Our role is to bring structure and insight to your financial journey, so you can focus on living the life you’ve worked hard to build.

Our clients

Where are you on your financial journey?

We work with individuals and families across all stages of life, providing clarity in a complex world. Our clients include professionals, entrepreneurs, business owners, high earners, and retirees, all with unique goals, challenges, and aspirations.

Who We Help

Whether you’re building your financial future or planning for the generations that follow, our role is to be your trusted partner every step of the way.

We specialise in supporting a select group of clients who value personalised, long-term financial advice.

Entrepreneurs & Business Owners

You’ve worked hard to build something meaningful, now it’s time to make sure your wealth works as hard as you have.

Whether you’re scaling a company, planning an exit, or navigating the complexities of business ownership, we help you take control of your financial future with clarity and confidence.

Our role is to free up your time, reduce uncertainty, and bring strategic insight to your personal and business finances.

We understand that your personal wealth is often closely tied to your business. Our advice helps you separate the two, prepare for key transitions, and optimise every stage of your financial journey, from growth to exit, and beyond.

You might be:

- Growing a business or advancing your career

- Saving for your first home or your children’s education

- Building pension and investment portfolios

How we help:

- Establish disciplined saving and investment habits

- Use tax-efficient structures to grow your wealth

- Develop a flexible plan that evolves with your life

- Avoid early financial missteps that can cost you later

Professionals & High Earners

You’ve built a successful career and accumulated meaningful wealth, but time is short, life is busy, and the financial decisions only grow more complex.

We work with senior professionals, executives, partners, and high earners who want to protect and grow their wealth while planning for the future. Whether you’re balancing family priorities, planning retirement, or navigating high tax liabilities, we provide clear, proactive advice that helps you take control, without needing to become a financial expert yourself.

We’ll help you align your wealth with your goals, avoid common planning pitfalls, and ensure your capital supports both your lifestyle and legacy.

What matters to you:

- Maintaining your lifestyle today and into retirement

- Securing your family’s future with thoughtful financial planning

- Making confident, well-informed decisions about your capital

- Managing tax exposure efficiently

- Building long-term wealth without sacrificing time or peace of mind

How we help:

- Create a clear, tax-aware investment strategy tailored to your earnings and goals

- Structure savings across pensions, ISAs, and trusts to support future income

- Build a personal balance sheet alongside your professional one

- Clarify how your choices today affect your long-term wealth

- Support life transitions such as promotion, family changes, or retirement planning

Retirees & Their Families

After years of working and saving, retirement is your time to enjoy life, without uncertainty or financial stress.

We help retirees and their families feel secure, supported, and confident that their wealth will last. Whether you’re drawing an income, planning for care needs, or thinking about how best to pass on your legacy, our team is here to provide structure, clarity, and peace of mind.

You’ve earned the freedom to focus on what matters most, family, lifestyle, and security. We’ll take care of the rest.

What matters to you:

- Maintaining your standard of living without worrying about running out

- Feeling well supported and in control of your finances

- Making sure your spouse or partner is equally well cared for

- Passing on wealth to children and grandchildren in the right way

- Planning ahead for care needs or future expenses

How we help:

- Build a reliable income strategy from your pensions, ISAs, and investments

- Stress-test your plan to ensure sustainability and flexibility

- Help with estate planning, inheritance tax, and gifting strategies

- Provide ongoing advice and support for both partners

- Adapt your plan as life circumstances change

Why This Matters

At Tacit Investment Management, we understand that wealth isn’t just about money, it’s about security, purpose, and legacy.

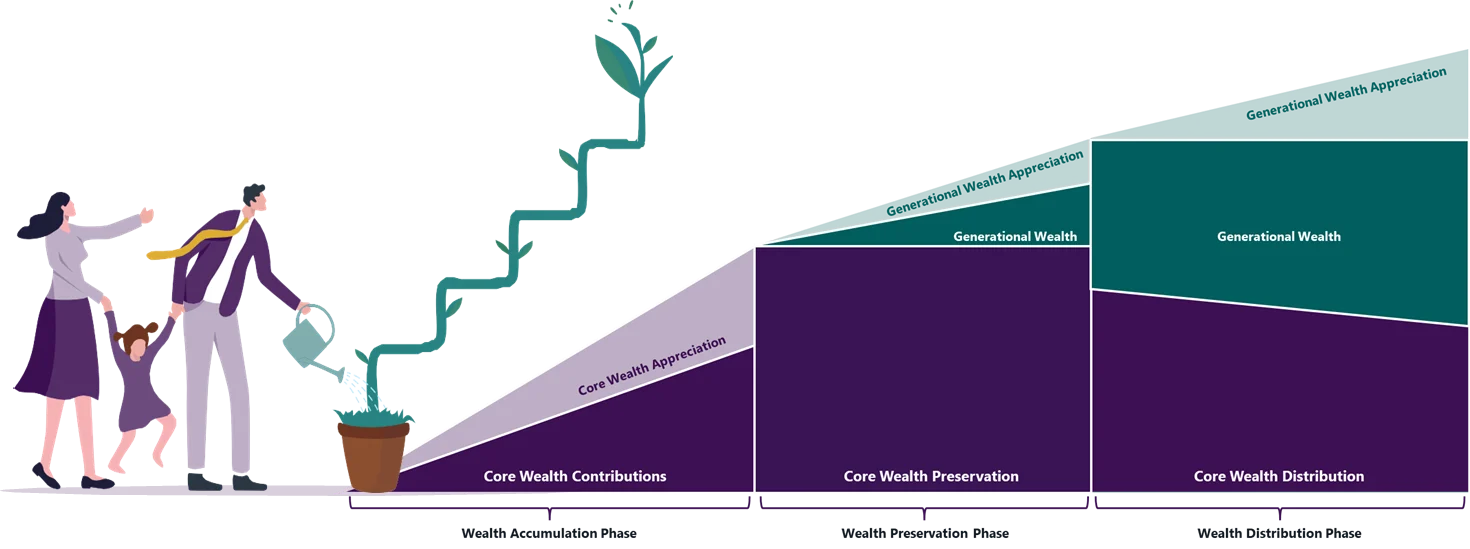

Our approach is structured around the three key phases of the financial lifecycle, tailored to your evolving needs and ambitions.

- We tailor your portfolio as your life evolves, not just your investments

- Our approach helps you balance lifestyle needs with legacy intentions

- We support you through financial milestones and transitions, across generations

Not Sure Where You Are on the Journey?

Everyone’s financial path is different, and it’s not always easy to know exactly where you fit. That’s why we take the time to understand your circumstances, goals and concerns, before recommending a strategy or service. Whether you’re building your wealth, planning for retirement, or thinking about the next generation, we’ll help you work out what matters most, and how we can support you.

Wealth Accumulation

Laying the Foundation for Your Future

This is a phase of momentum. Your career is taking shape, your income is growing, and you’re beginning to think more seriously about the future, for yourself and those you care about.

Whether you’re building a business, climbing the professional ladder, or juggling young family commitments, now is the time to set strong financial foundations. The decisions made at this stage, about saving, investing, borrowing and protecting, can shape your options for years to come.

We help you establish clarity and discipline early on, so your growing wealth supports the life you’re building, not just today, but in the decades ahead.

You might be:

- Growing a business or advancing in a demanding career

- Saving for your first home or planning for school fees

- Starting to build pension and investment portfolios

- Balancing earnings with lifestyle and family priorities

How we help:

- Establish disciplined saving and investment habits

- Use tax-efficient structures like ISAs, pensions, and trusts to grow your wealth

- Build a flexible plan that evolves as your career and circumstances change

- Avoid early missteps that can delay long-term financial goals

Wealth Preservation & Optimisation

Protecting and Preparing for What’s Next

You’ve worked hard to build your wealth, and now it’s time to make sure it works just as hard for you.

At this stage, you’re likely in your peak earning years, with meaningful assets already in place. You may be planning for retirement, reassessing your work-life balance, or thinking about how best to support your children or future generations. Life is evolving, and your financial strategy needs to evolve with it.

We help you preserve what you’ve built, manage risk sensibly, and fine-tune your investments to support both near-term lifestyle needs and longer-term aspirations.

You might be:

- In your peak earning years, with significant personal and business assets

- Preparing for retirement, a liquidity event, or career transition

- Reviewing plans to support children, family, or future generations

- Thinking more actively about tax efficiency and wealth transfer

How we help:

- Align your investment strategy with your evolving goals and risk tolerance

- Balance long-term growth with the stability you need as life becomes more complex

- Prepare for future income needs, including retirement and lifestyle planning

- Introduce strategies for tax-efficient gifting, inheritance and succession

Wealth Distribution

Turning Wealth into Legacy

This is a time to enjoy the life you’ve worked hard to create, and to take comfort in knowing your wealth is supporting the people and causes that matter most.

Whether you’re retired, semi-retired, or managing wealth across generations, the focus shifts from accumulation to stewardship. You may be drawing income, helping your children or grandchildren, or considering how best to give back. You want your wealth to last, to be used wisely, and to reflect your values.

We help you bring clarity to these decisions, so your financial legacy is intentional, efficient, and meaningful.

You might be:

- Retired or semi-retired and relying on your portfolio for income

- Supporting children, grandchildren, or charitable causes

- Looking to simplify your finances and reduce complexity

- Planning your estate and thinking about inheritance

How we help:

- Create sustainable income strategies that preserve capital and flexibility

- Separate core lifestyle wealth from longer-term legacy capital

- Structure tax-efficient inheritance and lifetime gifting plans

- Ensure your legacy is aligned with your values and intentions

A Smarter Way to Structure Wealth

Balancing your needs today with the legacy you want to leave tomorrow

Our wealth management approach recognises that not all capital serves the same purpose. That’s why we help you think about your financial resources in two distinct categories: Core Wealth and Generational Wealth.

Core Wealth is the capital you rely on to support your lifestyle, provide financial security, and meet life’s expected (and unexpected) needs. It’s about protecting what you’ve built and ensuring it can deliver for you, comfortably and reliably.

Generational Wealth represents the capital you won’t need during your lifetime. This is where we help you look further ahead, supporting loved ones, creating a lasting legacy, or backing causes that matter to you.

By separating your wealth in this way, we can create tailored strategies for each, with the right level of risk, tax treatment, and flexibility. Your Core Wealth remains focused on stability, access and sustainability. Your Generational Wealth can be managed for long-term growth, legacy planning, and impact.

It’s a powerful way to make your money work harder, with clarity and purpose.

What our clients say

All in all a great organisation that we are happy to continue our association.”

Experience suggests when a service provider consistently provides up-to-date and insightful reviews, exemplary face to face meetings not just structured but always open to dialogue, questioning and on occasion deep dive into the subject.

Complement this with a clear understanding of their individual clients circumstance underpin with market leading support and advice Tacit Investment Management tick all the boxes and regularly exceed competitors performance.

In summary for a client centric approach underpinned by a comprehensive and up-to-date knowledge base Tacit Investment Management hit the mark.”

Begin your journey

Whether you’re just starting out, at a turning point, or thinking about the next generation, we’d be delighted to explore how we can help, wherever you are in your financial life.

Tell us a little about yourself using the form below, and a member of our team will be in touch to talk through your goals and the services most relevant to you.

Prefer to speak directly? Call us on 0203 051 6450, we’d be happy to hear from you.